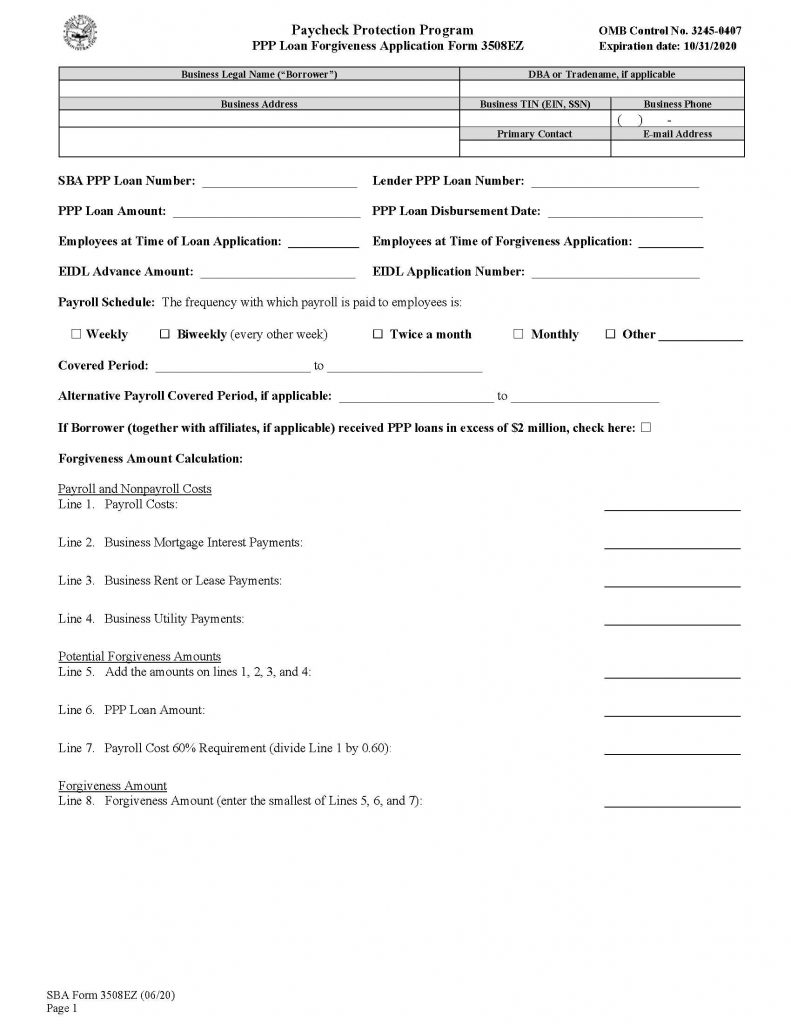

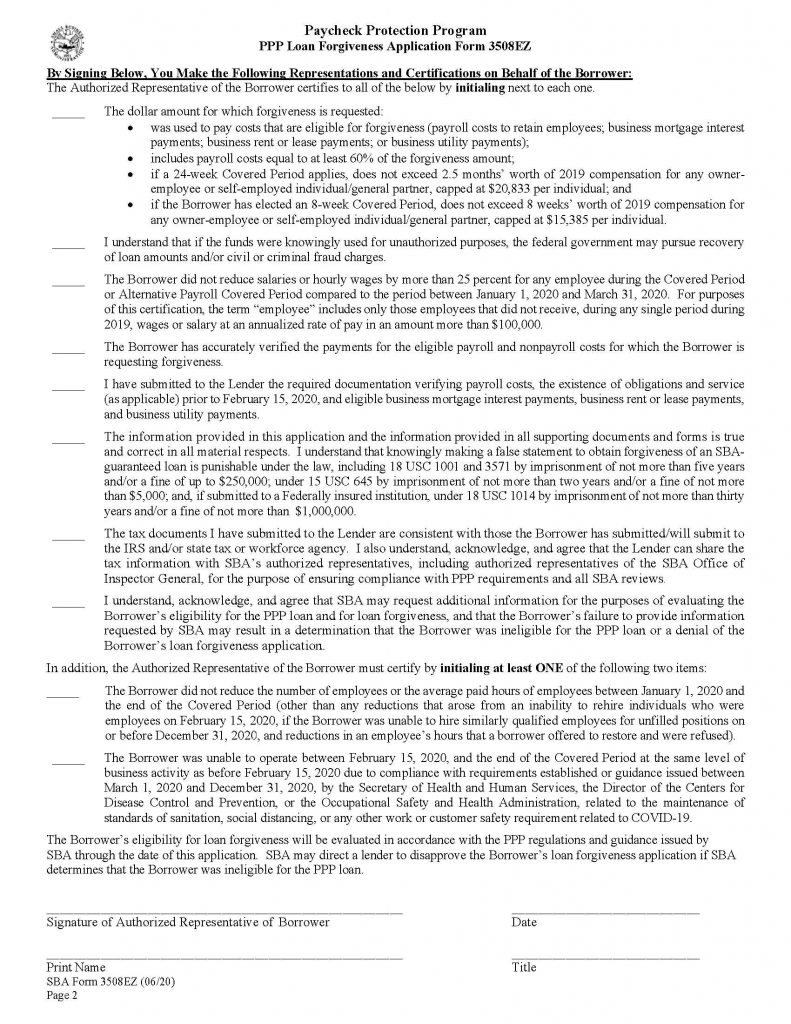

The Paycheck Protection Program (PPP) enables eligible entities to qualify for a loan of up to $10 million to keep their workers employed. The best part is the loan is subject to forgiveness if approved borrowers meet certain requirements as defined in SBA regarding the disbursement of the funds including expenditures for maintaining payroll and other permitted uses, such as mortgage interest, rent and utilities.

The regulations contain very specific spending and documentation requirements that are essential for achieving debt forgiveness under the program. Rink & Robinson, PLLC encourages businesses to be proactive with their lenders and work quickly to apply and understand the requirements for loan forgiveness benefits.

How Rink & Robinson, PLLC helps maximize PPP loan forgiveness

- We will assist both borrowers and lenders with the necessary verification for PPP loan forgiveness. Our advisors will work closely with borrowers to assist them to maximize their loan forgiveness benefits.

- PPP Loan Funds Planning – R&R CPA’s assist you in the documentation of need relative to loan application, as well as the requirements for spending and proper allocation and timing of funds to maximize forgiveness.

- Loan Forgiveness Forecasting and Tracking – We work closely with borrowers to monitor and provide the accountability to ensure spending is appropriate for receiving loan forgiveness.

- Concluding Documentation – Your CPA advisory team will assist you in assembling the required borrower documentation and assist you in completing any necessary compliance reporting for your lending institution.

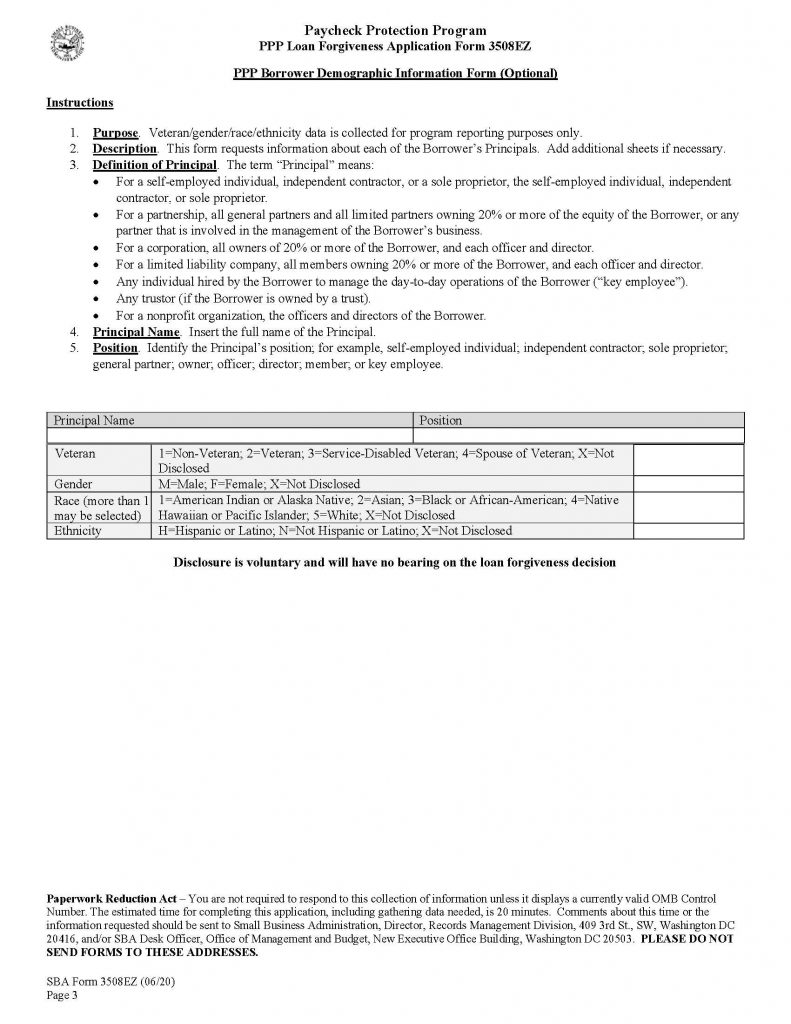

Below is a copy of the Application. A link below is provide for you convenience. Call us for help!